Abstract

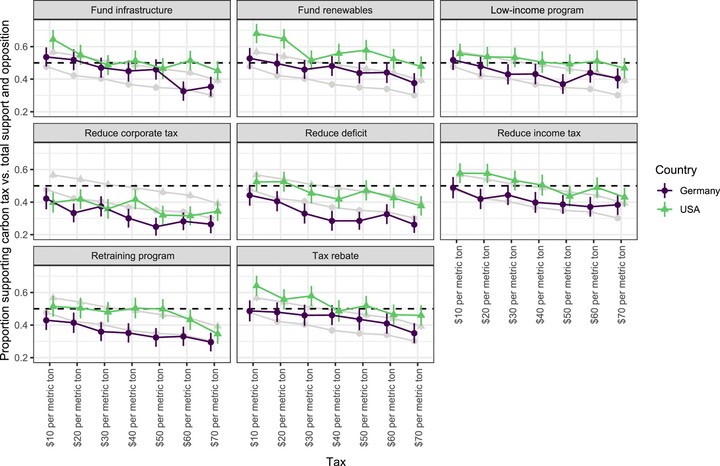

Carbon taxes are widely regarded as a potentially effective and economically efficient policy instrument for decarbonizing the global energy supply and thus limiting global warming. The main obstacle is political feasibility because of opposition from citizens and industry. Earmarking revenues from carbon taxation for spending that benefits citizens (i.e., revenue recycling) might help policy makers escape this political impasse. On the basis of choice experiments with representative samples of citizens in Germany and the United States, we examine whether revenue recycling could mitigate two key obstacles to achieving sufficient public support for carbon taxes (i) declines in support as taxation levels increase and (ii) concerns over the international economic level playing field. For both countries, we find that revenue recycling could help achieve majority support for carbon tax levels of up to $50 to $70 per metric ton of carbon, but only if industrialized countries join forces and adopt similar carbon taxes.